Call Anytime 24/7

Mail Us For Support

Office Address

Dennis Pritt Road Nairobi, Kenya

China’s exports are not accelerating-Beware base year effects

By Simon J. Evenett

At this critical juncture for world trade, particular care is needed in interpreting monthly Chinese export releases. Atypically low exports in 2023 inflate the 2024 year-on-year percentage increases in monthly Chinese exports. Better to compare the officially released year-to-date export totals, available at present from 2021. These show that Chinese exports have grown in value by 3.2% per annum, hardly a surge. Chinese exports to Japan and USA are currently below levels seen during the first 10 months of 2021; to the EU they have barely risen. Such data undermine the case for raising trade barriers on the grounds that Chinese aggregate exports are “accelerating.”

With the prospect of higher tariffs being imposed next year on Chinese exports to the United States, those seeking immediate relief from Chinese competitors are arguing that exports from that country are already accelerating. In these tense times, the monthly official release of Chinese export data takes on particular importance.

As shown here, largely because Chinese exports in 2023 were atypically low, the calculated year-on-year percentage increases in Chinese monthly exports for this year are high. This has resulted in headlines such as “Chinese exports soar as Beijing prepares for trade tensions with Donald Trump,” published on 7th November 2024 after the October 2024 official release of Chinese monthly export data. These headlines are misleading and are probably being used by lobbyists for protectionism in Europe and elsewhere.

Rookie data analysts are warned about how base year effects can mislead. They are also taught about the noise in monthly data reports and the value in using longer intervals when such data are available. Both are relevant here.

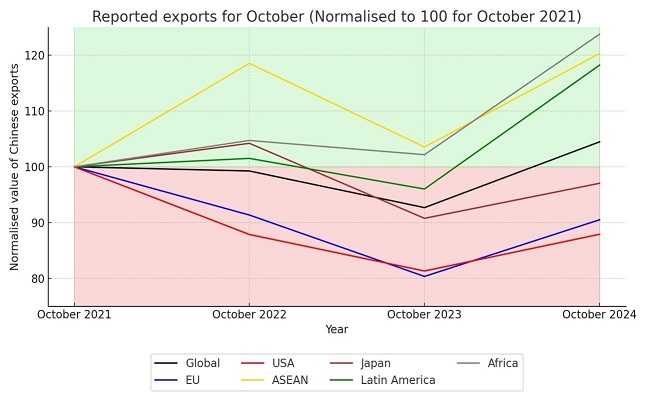

Figure 1 reports monthly Chinese export totals in US dollars for October 2021, 2022, 2023 and 2024. Global export totals are reported plus exports to certain trading partners. It is guaranteed to generate large numbers, which can be deployed artfully to frighten decision-makers. In fact, Chinese global exports in October 2024 were just 4.5% above October 2021 levels.

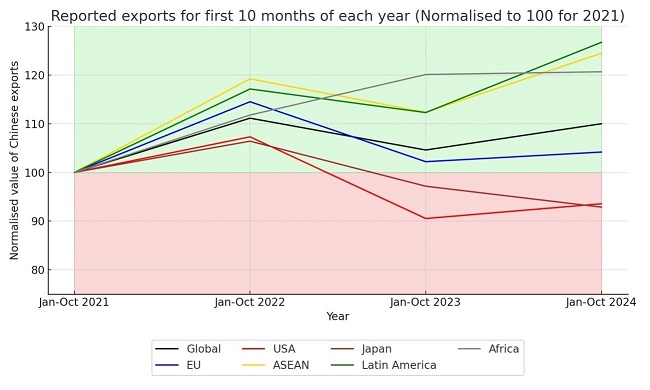

This base year error in not a one-off. Similar approaches were taken in reporting on monthly official releases relating to August 2024, July 2024, June 2024, May 2024, and April 2024. Why does it matter? These reports have fueled the narrative that China is flooding global markets to accelerate its economic growth through exports. China also releases year-to-year export totals each month. Such totals provide a more reliable sense of Chinese export performance as the noise in any one month’s reported totals get less weight. Again, such export data was normalised to 100 for 2021 and the results are found in Figure 2. Yes, Chinese global exports are up 5.1% on the first 10 months of 2023. But overall exports over this time frame are still well below their 2022 total. The 2024 total implies annual Chinese export growth since 2021 of just 3.2%. So much for the exporting-out-of-recession narrative. An export recovery story better fits the data.

Seen over the more sensible year-to-date time frame, Chinese exports to Japan and the United States in 2024 are still below 2021 levels. Chinese exports to the EU are well below the 2022 peak. The notion that, as a general matter, Chinese exports to the West are accelerating ahead of new Trump tariffs is not supported by this data.

Where 2024 Chinese exports are more than 20% above 2021 levels is to Africa, ASEAN, and Latin America. Only the latter two regions saw year-to-date 2024 exports 10% above levels seen in 2023. Chinese exports to Africa this year are flat.

The key takeaway: Trade policy should not be based on alarmist headlines resulting from rookie data errors. Having written that, even though China’s overall exports aren’t accelerating, shipments may be taking off in selected products. Better focus attention on that.

Simon J. Evenett, an international trade economist, is Professor of Geopolitics & Strategy at IMD Business School, Switzerland. He is also Founder of the St. Gallen Endowment for Prosperity Through Trade, home of the independent monitoring initiatives Global Trade Alert, Digital Policy Alert and the New Industrial Policy Observatory and Co-Chair of the World Economic Forum’s Global Futures Council on Trade & Investment.

Figure 1: Recorded Chinese monthly exports for October 2023 were unusually low.

Figure 2: Chinese exports to the EU, Japan and the USA are actually below those seen in 2022.

Data source for both charts: Trade Data Monitor, assembled from official Chinese data releases.